|

|

| Contents |

Introduction to the ftwilliam.com software. Top |

|

You will need the company code, login name and password you received when you signed up for the ftwilliam.com system.

General ftwilliam.com website features available after log-in:

|

|

|

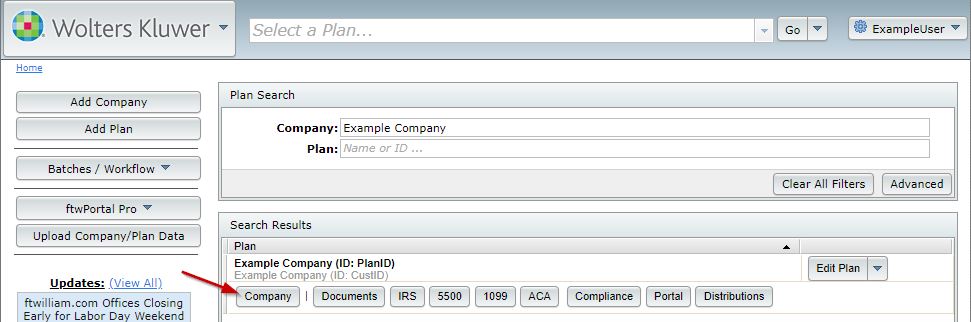

After log-in, you will be taken to the "Select Company" page where you can Add Company / Select Company / Delete Company. First time ftwilliam.com users will need to add a company to get started. The 55AutoFill feature will import company information from 5500 form filings. All you need to do is enter the plan sponsor's taxpayer identification number and basic plan and company information for that plan sponsor are automatically imported for your use - even if you did not use our software in any previous year. (Patent pending).

A Company that will already be in place when you first log in is the Company "ZZZ - Default Plans". (It is named "ZZZ" so that it will appear last in your list of Companies.) You may want to start by opening the default company plans and reviewing the plan specifications. These specifications will be used whenever you add a new plan to the system (unless you clone a plan). In addition, the 'Select Company' page includes 'Quick links' to many batch features, links to all our recent technical updates, recent email announcements, a link to our 'Upload Center' (contact support for more information if you are interested in the Upload features), and User Guides. |

|

|

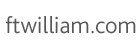

After selecting a Company, you will be taken to the "Select Plan" page. First time ftwilliam.com users may need to add a plan to get started.

Note that you can only add plans related to your current document subscription. For example, if you have a retirement documents subscription but not welfare documents, you will be able to add any plan in the retirement document subscription but will not see options to add cafeteria or other welfare plans. Contact us at any time to add subscriptions to your account. |

|

|

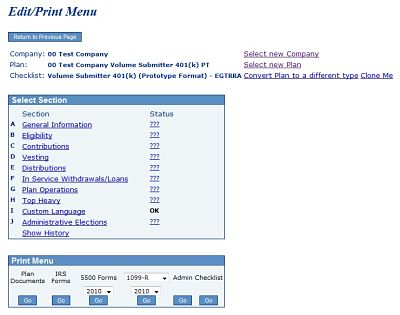

After selecting a Plan, you will be taken to the "Edit/Print Menu" page. The different sections of the checklist will appear in the 'Select Section' box. Click on each section to enter relevant plan specifications. Make sure to click 'Update' to save your changes and trigger any applicable edit checks.

At the bottom of the page, under the "Print Menu", are options to access specific software features for this plan: Documents/IRS Forms/5500 forms/1099s/Admin/Portal. Items where you do not have an subscription will appear as 'N/A' instead of having a "Go" button. The page shown at right displays what it looks like if you have a plan documents subscription with ftwilliam.com. It may look different and have different options under the "Print Menu" depending upon the subscriptions you have with ftwilliam.com. |

|

Details on each of the relevant software features are provided in separate user guides. The links to those user guides is provided below:

Click on "Go" under "IRS Forms" to access IRS forms software.

IRS/PBGC Forms Package

|

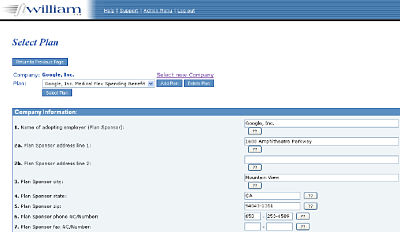

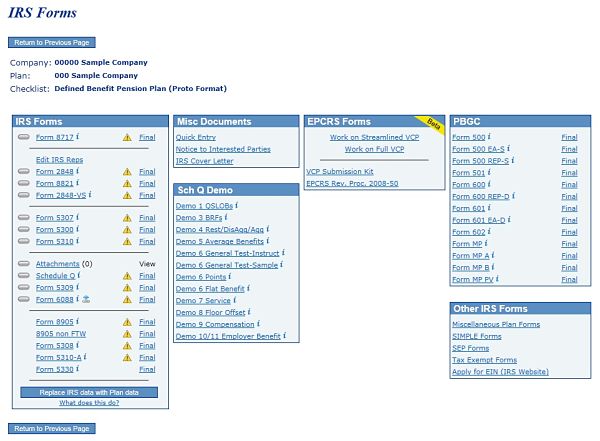

After you click on "Go" under "IRS Forms" from the 'Edit/Print Menu' page you will be taken to the 'IRS Forms' page shown at right.

Note the forms and materials you have access to on the IRS Forms page will depend upon your subscription with ftwilliam.com. Retirement document subscribers that do not have an IRS forms subscription will have access to the following forms only:

|

|

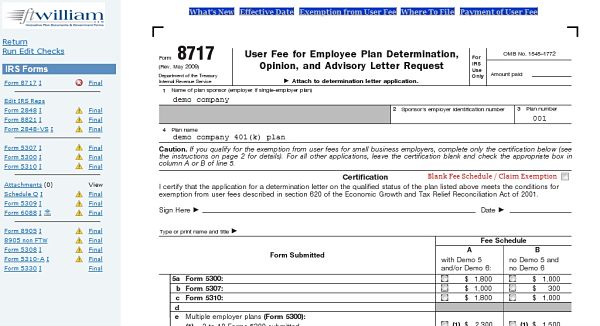

IRS Forms. TopClick on the name of the form you wish to edit and the form will open in a screen where you can enter and edit information (shown at right). There is no need to click 'Update' buttons. Once information is entered, it is saved in the system.Note that once a form is opened, you can navigate to other forms directly from the menu shown on the left-hand side of the page. You can also 'Run Edit Checks' for the form that is open on your screen. (See the Edit Checks section of this guide for more information.)

|

|

A user with "Edit" privileges may add/modify/delete IRS representatives by clicking on the "Edit IRS Reps" link in the "IRS Forms" box (a screen should pop open to allow you to enter an IRS Rep). After an IRS representative has been added, you may select that representative to appear on the Form 2848 by clicking on that person's name in Item 2 of Part I of the Form 2848 and clicking your cursor to another place on the page. If the IRS representative will appear on the Form 5300/5307/5310 rather than the Form 2848, you should make sure the appropriate box on line 2a of the Form 5300/5307/5310 is not checked. When this box is not checked, you may select that representative to appear on the Form 5300/5307/5310 by clicking on that person's name in Item 2 and clicking your cursor to another place on the page.

Once a representative has been added using the "Edit IRS Reps" link, there is no need reenter his or her information on each new form. To clear a representative's name from the form, Choose the IRS Rep of "None" and click your cursor to another place on the page.

You may select the default IRS representative that will appear on all new forms by clicking on the "Admin Menu" link on the top of the page and selecting "Edit Company Profile".

|

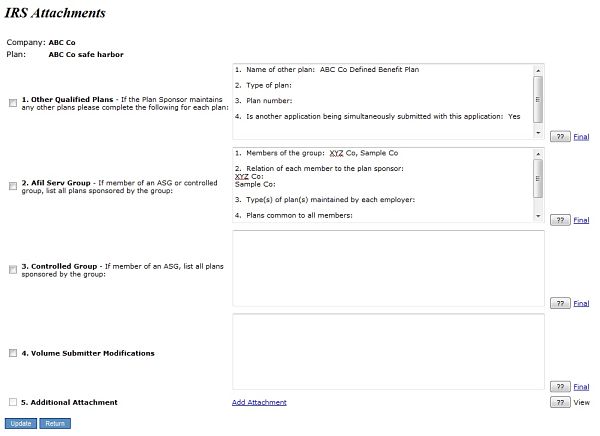

The following standard attachments are included and will be pre-populated to the extent possible based on data entered into the ftwilliam.com system:

To select and include an attachment with your final filing, click in the box next to the attachment name. You can also print each attachment separately from this screen by clicking on 'Final' to the right of the applicable attachment on the 'IRS Attachments' page.

|

|

To include an additional attachment, click on the link 'Add Attachment'. You will be prompted to browse for a PDF file on your computer to upload.

Be sure to click the 'Update' button to save your changes to this page.

When you click the "Replace IRS data with Plan data" button much of the data currently in the IRS forms will be refreshed based on data from the document checklist. However, participant counts will be pulled from your most recent 5500EZ, last accepted 5500SF, or last accepted 5500 plus Sch. I or H.

This same process occurs automatically the first time you enter any IRS form for a particular plan. Use this button with caution if you have made significant changes to the document checklist after already starting work on an IRS form. Use this button only if you wish to start over.

This process may not be undone. We strongly suggest saving any forms to your desktop before clicking to replace IRS data with Plan data.

The first step is to add individual forms to the filing package. This is done by clicking on the grey image ( ) next to the form. Selected forms will turn green (

) next to the form. Selected forms will turn green ( ). To un-select, click on the green image and it will turn back to grey.

). To un-select, click on the green image and it will turn back to grey.

To edit-check the selected forms, click on the 'Edit Check All Selected IRS Forms' link under the 'IRS Forms' box (this will only appear if at least one form is selected).

To print a complete filing package, click on the 'Print All Selected IRS Forms' link under the 'IRS Forms' box. Clicking this link will generate a single pdf file with all selected forms included.

You may print a single form by clicking on the link 'Final' across from the applicable form. Clicking this link will generate a single pdf file. You may print the form and/or save it to your desktop.

Options under the "Misc Documents" box include Quick Entry, Notice to Interested Parties and IRS Cover Letter. Click on 'Quick Entry' to enter the date the Plan is to be submitted to IRS for the Notice to Interested Parties and IRS Cover Letter. You can also enter the testing date if the Plan is providing testing data in 'Quick Entry'.

The Schedule Q demos under the 'Sch Q Demo' box are all generally sample demonstrations/instructions that you can modify and save in Microsoft Word on your computer. To view the instructions for the different demonstrations, click here.

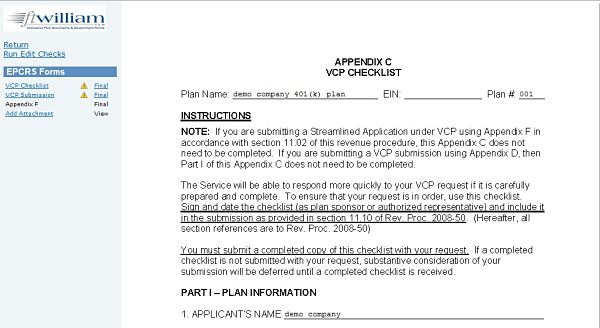

EPCRS Forms. TopClick on the type of EPCRS filing you want to complete (streamlined or full) then click on the name of the form you wish to edit and the form will open in a screen where you can enter and edit information (full filing shown at right). There is no need to click 'Update' buttons. Once information is entered, it is saved in the system.New form options will generally be available to complete if you have indicated elsewhere that the particular form/schedule/Appendix should be completed. Note that once a form is opened, you can navigate to other forms directly from the menu shown on the left-hand side of the page. You can also 'Run Edit Checks' for the form that is open on your screen. Links are also provided for your reference to VCP Submission Kit and EPCRS Rev. Proc. 2008-50.

|

|

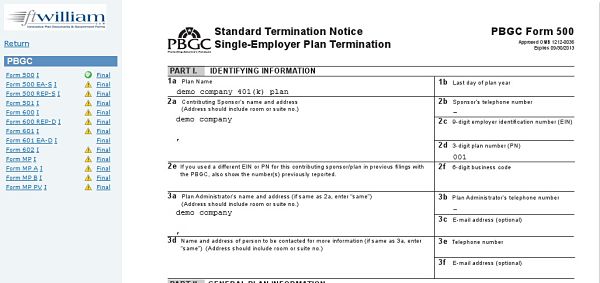

Edit PBGC Forms. TopClick on the name of the form you wish to edit and the form will open in a screen where you can enter and edit information (shown at right). There is no need to click 'Update' buttons. Once information is entered, it is saved in the system.Note that once a form is opened, you can navigate to other forms directly from the menu shown on the left-hand side of the page. You can also 'Run Edit Checks' for the form that is open on your screen.

|

|

There are a few ways to run edit checks on a form:

,

,  or

or  ) next to the appropriate form. This will open a list of errors in a new window. If you have the form open at the same time, you can click on '(Go To)' and the form will move the item to the top of the page.

) next to the appropriate form. This will open a list of errors in a new window. If you have the form open at the same time, you can click on '(Go To)' and the form will move the item to the top of the page.

Immediately before printing the final version of a form, it is a good idea to rerun the edit checks even if the all status codes are "OK". The following is a description of the status codes:

| Symbol | Meaning |

| Unknown Status: edit checks have not yet been run or edit checks have not been run since a change was made to the form. |

| NOT OK: Edit checks have been run and the form has errors. |

| OK: Edit checks have been run and discovered no errors. |

1. On the main IRS/PBGC page, you may click on the ![]() next to the appropriate form. This will display a page with the full text of the instructions for the applicable form.

next to the appropriate form. This will display a page with the full text of the instructions for the applicable form.

2. When you are entering data on a form, you may click on the blue buttons with question marks next to the line item on the form to read the materials related to that line item.