2015 Form 5500 Instructions

Annual Return/Report of Employee Benefit Plan

Close Help Page

| View

Official Instructions | Quick

Reference Chart | Business Codes | Characteristics Codes |

Table of Contents

Code section references are to the Internal Revenue Code

unless otherwise noted. ERISA refers to the Employee Retirement Income

Security Act of 1974.

Under the computerized ERISA Filing Acceptance System

(EFAST2), you must electronically file your 2015 Form 5500. Your Form

5500 entries will be initially screened electronically. For more

information, see the instructions for Electronic

Filing Requirement and the EFAST2 website at www.efast.dol.gov.

You cannot file a paper Form 5500 by mail or other delivery service.

The Form 5500, Annual Return/Report of Employee Benefit Plan,

including all required schedules and attachments (Form 5500

return/report), is used to report information concerning employee

benefit plans and Direct Filing Entities (DFEs). Any administrator or

sponsor of an employee benefit plan subject to ERISA must file

information about each benefit plan every year (pursuant to Code

section 6058 and ERISA sections 104 and 4065). Some plans participate

in certain trusts, accounts, and other investment arrangements that

file a Form 5500 annual return/report as DFEs. See Who Must File and When

To File.

The Internal Revenue Service (IRS), Department of Labor

(DOL), and Pension Benefit Guaranty Corporation (PBGC) have

consolidated certain returns and report forms to reduce the filing

burden for plan administrators and employers. Employers and

administrators who comply with the instructions for the Form 5500

generally will satisfy the annual reporting requirements for the IRS

and DOL.

Defined contribution and defined benefit pension plans may

have to file additional information with the IRS including Form 5330,

Return of Excise Taxes Related to Employee Benefit Plans, Form

5310-A, Notice of Plan Merger or Consolidation, Spinoff, or Transfer of

Plan Assets or Liabilities; Notice of Qualified Separate Lines of

Business, and Form 8955-SSA, Annual Registration Statement Identifying

Separated Participants with Deferred Vested Benefits. See www.irs.gov

for more information.

Plans covered by the PBGC have special additional

requirements, including premiums and reporting certain transactions

directly with that agency. See PBGC's website (www.pbgc.gov/practitioners/)

for information on premium payments and reporting and disclosure.

Each Form 5500 must accurately reflect the characteristics

and operations that applied during the reporting year of the

plan arrangement. The

requirements for

completing the Form 5500 will vary according to the type of plan or

arrangement. The section What

To

File

summarizes what information must be reported for different types of

plans and arrangements. The Quick Reference Chart of

Form 5500, Schedules and Attachments, gives a brief guide to

the annual return/report requirements of

the 2015 Form 5500. See also the "Troubleshooters Guide to Filing the

ERISA Annual Reports" available on www.dol.gov/ebsa,

which is intended to help filers comply with the Form 5500 and Form

5500-SF annual reporting requirements and avoid common reporting

errors.

The Form 5500 must be filed electronically as noted above.

See Section 3 - Electronic

Filing

Requirement and the EFAST2 website at www.efast.dol.gov.

Your Form 5500 entries will

be initially screened electronically. Your entries must satisfy this

screening for your filing to be received. Once received, your form may

be subject to further detailed review, and your filing may be rejected

based upon this further review.

ERISA and the Code

provide for the assessment or imposition

of penalties for not submitting the

required information when due. See Penalties.

Annual reports filed under Title I of ERISA must be made

available by plan administrators to plan participants and beneficiaries

and by

the DOL to the public pursuant to ERISA sections 104 and 106. Pursuant

to Section 504 of the Pension Protection Act of 2006 (PPA) Pub. L.

109-280, this

availability for defined benefit pension plans must include the posting

of identification and basic plan information and actuarial

information (Form 5500, Schedule SB or MB, and all of the Schedule SB

or MB attachments) on any plan sponsor intranet website (or website

maintained by the plan administrator on behalf of the plan sponsor)

that is used for the purpose of communicating with employees and not

the

public. Section 504 also requires DOL to display such information on

DOL's website within 90 days after the filing of the plan's annual

return/report. To see plan year 2009 and later Forms 5500, including

actuarial information, see www.dol.gov/ebsa.

See www.dol.gov/ebsa/actuarialsearch.html

for 2008 and short plan year 2009 actuarial information filed under the

previous

paper-based system.

On

September 29, 2014, the Treasury Department issues

final regulations under sections 6058 and 6059 of the Code providing

that

certain filers must electronically file the Form 5500 series

returns/reports

(including actuarial schedules). (See T.D. 9695, 79 FR 58256 at http://federalregister.gov/a/2014-23161).

Under the regulations you are required

to file a Form 5500 series returns/reports electronically if you are

required

to file at least 250 returns of all types during the calendar year that

includes the first day of the applicable plan year. Because the IRS may

now

require certain filers to electronically file the Form 5500 series

returns/reports, the IRS is adding questions to the Form 5500 and its

Schedules

relating solely to IRS compliance issues. However, these new IRS

compliance

questions are optional for the 2015 plan year.

IRS Compliance Questions. (optional

for the 2015 plan year):

- New

Lines 4o, 4p, 6c, and 6d were added to Schedules H and I. The IRS

has decided not to require plan sponsors to complete these questions

for the 2015 plan year and plan sponsors should skip these questions

when completing the form.

- New

Part VII (IRS Compliance Questions) was added to Schedule R for

purposes of satisfying the reporting requirements of Section 6058 of

the Code. The IRS has decided not to require plan sponsors to

complete these questions for the 2015 plan year and plan sponsors

should skip these questions when completing the form.

Schedule MB. The

instructions are modified to add RP-2000 and

RP-2000 (with Blue Collar Adjustment) to the list of mortality tables

for

non-disabled lives that plans may report in line 6c. The Schedule MB

and

instructions are also modified to add a new question in line 8b that

would

require large multiemployer plans (500 or more total participants as of

the

valuation date) to provide in an attachment a projection of expected

benefit

payments to be paid for the entire plan (not including expected

expenses) for

each of the next ten plan years starting with the plan year to which

the filing

relates. The Schedule MB is modified to require all multiemployer plans

to

report the funded percentage for monitoring the plan's status in line

4.

Previously, only plans in critical or endangered status were required

to report

this information. As a result of the Multiemployer Pension Reform Act

of 2014,

the Schedule MB and instructions are further modified to extend the

reporting

requirements in line 4 for multiemployer plans in critical status to

plans in

critical and declining status and require that additional

information to

be reported by plans that have been partitioned or have had benefits

suspended.

Schedule SB.

The instructions are modified to simplify the

alternative age/service scatters that cash balance plans with 1,000 or

more

active participants have an option to report on an attachment in line

26.

Form 5500 Final Return/Report for Plans

Trusteed by PBGC.

The instructions for "Final Return/Report" are modified to add a

statement that a filer for a terminated defined benefit plan for which

PBGC has been appointed trustee may contact DOL at PBGCTrusteedPlan@dol.gov

for further information.

If you need help completing this form or have related

questions, call the EFAST2 Help Line at 1-866-GO-EFAST (1-866-463-3278)

(toll-free) or

access the EFAST2 or IRS websites. The EFAST2 Help Line is available

Monday through Friday from 8:00 am to 8:00 pm, Eastern Time.

You can access the EFAST2 website 24 hours a day, 7 days a

week at www.efast.dol.gov

to:

- File the Form 5500-SF or 5500, and any needed schedules

or attachments.

- Check on the status of a filing you submitted.

- View filings posted by EFAST2.

- Register for electronic credentials to sign or submit

filings.

- View forms and related instructions.

- Get information regarding EFAST2, including approved

software vendors.

- See answers to frequently asked questions about the Form

5500-SF, the Form 5500 and its schedules, and EFAST2.

- Access the main EBSA and DOL websites for news,

regulations, and publications.

You can access the IRS website 24 hours a day, 7 days a week

at www.irs.gov

to:

- View forms, instructions, and publications.

- See answers to frequently asked tax questions.

- Search publications on-line by topic or keyword.

- Send comments or request help by e-mail.

- Sign up to receive local and national tax news by e-mail.

You can order other IRS forms and publications by

calling 1-800-TAX-FORM

(1-800-829-3676). You can order EBSA publications by

calling 1-866-444-EBS (3272).

A return/report must be filed every year for every pension

benefit plan, welfare benefit plan, and for every entity that files as

a DFE as

specified below (pursuant to Code section 6058 and ERISA sections 104

and 4065).

If you are a small plan (generally under 100 participants at

the beginning of the plan year), you may be eligible to file the Form

5500-SF instead of the Form 5500. For more information, see the

instructions to the Form

5500-SF.

All pension benefit plans covered by ERISA must file an

annual return/report except as provided in this section. The

return/report must be

filed whether or not the plan is "tax-qualified," benefits no longer

accrue, contributions were not made this plan year, or contributions

are no

longer made. Pension benefit plans required to file include both

defined benefit plans and defined contribution plans.

The

following are among the pension benefit plans for which a

return/report must be filed.

- Profit-sharing plans, stock bonus plans, money purchase

plans, 401(k) plans, etc.

- Annuity arrangements under Code section 403(b)(1) and

custodial accounts established under Code section 403(b)(7) for

regulated

investment company stock. For more information regarding filing

requirements for 403(b) plans subject to Title I of ERISA, see Field

Assistance Bulletins 2009-02 and 2010-01.

- Individual retirement accounts (IRAs) established by an

employer under Code section 408(c).

- Church pension plans electing coverage under Code section

410(d).

- Pension benefit plans that cover residents of Puerto

Rico, the U.S. Virgin Islands, Guam, Wake Island, or American Samoa.

This includes a

plan that elects to have the provisions of section 1022(i)(2) of ERISA

apply.

- Plans that satisfy the Actual Deferral Percentage

requirements of Code section 401(k)(3)(A)(ii) by adopting the "SIMPLE"

provisions of

section 401(k)(11).

See What To File

for more information about what must be completed for pension plans.

Do Not File a Form 5500 for a Pension Benefit Plan

That Is Any of the Following:

- An unfunded excess benefit plan. See ERISA section

4(b)(5).

- An annuity or custodial account arrangement under Code

sections 403(b)(1) or (7) not established or maintained by an employer

as

described in DOL Regulation 29 CFR 2510.3-2(f).

- A Savings Incentive Match Plan for Employees of Small

Employers (SIMPLE) that involves SIMPLE IRAs under Code section 408(p).

- A simplified employee pension (SEP) or a salary reduction

SEP described in Code section 408(k) that conforms to the alternative

method of

compliance in 29 CFR 2520.104-48 or 2520.104-49. A SEP is a pension

plan that meets certain minimum qualifications regarding eligibility

and

employer contributions.

- A church pension benefit plan not electing coverage under

Code section 410(d).

- A pension plan that is maintained outside the United

States primarily for the benefit of persons substantially all of whom

are

nonresident aliens. However, certain foreign plans are required to file

the Form 5500-EZ

with the IRS or may file the Form 5500-SF, Short Form Annual

Return/Report of Employee Benefit Plan, electronically with EFAST2.

See the instructions to the Form

5500-EZ for the filing requirements. For more information, go

to www.irs.gov/ep

or call 1-877-829-5500.

- An unfunded pension plan for a select group of management

or highly compensated employees that meets the requirements of 29 CFR

2520.104-23, including timely filing of a registration statement with

the DOL.

- An unfunded dues financed pension benefit plan that meets

the alternative method of compliance provided by 29 CFR 2520.104-27.

- An individual retirement account or annuity not

considered a pension plan under 29 CFR 2510.3-2(d).

- A governmental plan.

- A "one-participant plan," as defined below. However,

certain one-participant plans are required to file the Form

5500-EZ, Annual

Return of One-Participant (Owners and Their Spouses) Retirement Plan

with the IRS or, if eligible, may file the Form 5500-SF,

Short

Form Annual Return/Report of Employee Benefit Plan, electronically with

EFAST2. For this purpose, a "one-participant plan" is:

- a pension benefit plan that covers only an individual

or an individual and his or her spouse who wholly own a trade or

business, whether incorporated or unincorporated; or

- a pension benefit plan for a partnership that covers

only the partners or the partners and the partners' spouses.

See the instructions to the Form 5500-EZ and the Form

5500-SF for eligibility conditions and filing requirements.

For more information, go to www.irs.gov/ep or

call 1-877-829-5500.

All welfare benefit plans covered by ERISA are required to

file a Form 5500 except as provided in this section. Welfare benefit

plans provide

benefits such as medical, dental, life insurance, apprenticeship and

training, scholarship funds, severance pay, disability, etc. See What To File for more

information.

Reminder: The administrator of an

employee welfare benefit plan that provides benefits wholly or

partially through a Multiple Employer Welfare Arrangement (MEWA) as

defined in ERISA section 3(40) must file a Form 5500, unless otherwise

exempt. Plans required to file a Form M-1, Report for Multiple Employer

Welfare Arrangements (MEWAs) and Certain Entities Claiming Exception

(ECEs), are not eligible for the filing exemption in 29 CFR 2520.104-20

described below. Such plans are required to file the Form 5500

regardless of the plan size or type of funding.

Do Not File a Form 5500 for a Welfare Benefit Plan

That Is Any of the Following:

- A welfare benefit plan that covered fewer than 100

participants as of the beginning of the plan year and is unfunded,

fully insured, or a combination of insured and unfunded, as specified

in 29 CFR 2520.104-20.

Note. To determine whether the plan covers

fewer than 100 participants for purposes of these filing exemptions for

insured and unfunded welfare plans, see instructions for lines 5 and 6 on

counting

participants in a welfare plan. See also 29 CFR 2510.3-3(d).

- An

unfunded welfare benefit plan has its benefits paid as needed directly

from the general assets of the employer or employee organization that

sponsors the plan.

Note. Plans that are NOT unfunded include

those plans that received employee (or former employee) contributions

during the plan year and/or used a trust or separately maintained fund

(including a Code section 501(c)(9) trust) to hold plan assets or act

as a conduit for the transfer of plan assets during the year. A welfare

benefit plan with employee contributions that is associated with a

cafeteria plan under Code section 125 may be treated for annual

reporting purposes as an unfunded welfare plan if it meets the

requirements of DOL Technical Release 92-01, 57 Fed. Reg. 23272 (June

2, 1992) and 58 Fed. Reg. 45359 (Aug. 27, 1993). The mere receipt of

COBRA contributions or other after-tax participant contributions (e.g.,

retiree contributions) by a cafeteria plan would not by itself affect

the availability of the relief provided for cafeteria plans that

otherwise meet the requirements of DOL Technical Release 92-01. See 61

Fed. Reg. 41220, 41222-23 (Aug. 7, 1996).

- A fully

insured welfare benefit plan has its benefits provided exclusively

through insurance contracts or policies, the premiums of which must be

paid directly to the insurance carrier by the employer or employee

organization from its general assets or partly from its general assets

and partly from contributions by its employees or members (which the

employer or employee organization forwards within three (3) months of

receipt). The insurance contracts or policies discussed above must be

issued by an insurance company or similar organization (such as Blue

Cross, Blue Shield or a health maintenance organization) that is

qualified to do business in any state.

- A combination unfunded/insured welfare benefit plan

has its benefits provided partially as an unfunded plan and partially

as a fully insured plan. An example of such a plan is a welfare benefit

plan that provides medical benefits as in a

above and life insurance benefits as in b

above. See 29 CFR 2520.104-20.

- A welfare benefit plan maintained outside the United

States primarily for persons substantially all of whom are nonresident

aliens.

- A governmental plan.

- An unfunded or insured welfare benefit plan maintained

for a select group of management or highly compensated employees, which

meets the requirements of 29 CFR 2520.104-24.

- An employee benefit plan maintained only to comply with

workers' compensation, unemployment compensation, or disability

insurance laws.

- A welfare benefit plan that participates in a group

insurance arrangement that files a Form 5500 on behalf of the welfare

benefit plan as specified in 29 CFR 2520.103-2. See 29 CFR 2520.104-43.

- An apprenticeship or training plan meeting all of the

conditions specified in 29 CFR 2520.104-22.

- An unfunded dues financed welfare benefit plan exempted

by 29 CFR 2520.104-26.

- A church plan under ERISA section 3(33).

- A welfare benefit plan maintained solely for (1) an

individual or an individual and his or her spouse, who wholly own a

trade or business, whether incorporated or unincorporated, or (2)

partners or the partners and the partners' spouses in a partnership.

See 29 CFR 2510.3-3(b).

Some plans participate in certain trusts, accounts, and

other investment arrangements that file the Form 5500 annual

return/report as a DFE in accordance with the Direct Filing

Entity (DFE) Filing Requirements. A Form 5500 must be filed

for a master trust investment account (MTIA). A Form 5500 is not

required but may be filed for a common/collective trust (CCT), pooled

separate account (PSA), 103-12 investment entity (103-12 IE), or group

insurance arrangement (GIA). Plans that participate in CCTs, PSAs,

103-12 IEs, or GIAs that file as DFEs, however, generally are eligible

for certain annual reporting relief. For reporting purposes, a CCT,

PSA, 103-12 IE, or GIA is not considered a DFE unless a Form 5500 and

all required attachments are filed for it in accordance with the Direct

Filing Entity (DFE) Filing Requirements.

Note. Special requirements also apply to

Schedules D

and H

attached to the Form 5500 filed by plans participating in MTIAs, CCTs,

PSAs, and 103-12 IEs. See these schedules and their instructions.

Plans and GIAs. File 2015 returns/reports

for plan and GIA years that began in 2015. All required forms,

schedules, statements, and attachments must be filed by the last day of

the 7th calendar month after the end of the plan

or GIA year (not to exceed 12 months in length) that began in 2015. If

the plan or GIA year differs from the 2015 calendar year, fill in the

fiscal year beginning and ending dates in the space provided.

DFEs other than GIAs. File 2015

returns/reports no later than 9½ months after the end of the DFE year

that ended in 2015. A Form 5500 filed for a DFE must report information

for the DFE year (not to exceed 12 months in length). If the DFE year

differs from the 2015 calendar year, fill in the fiscal year beginning

and ending dates in the space provided.

Short Years. For a plan year of less than

12 months (short plan year), file the form and applicable schedules by

the last day of the 7th calendar month after the

short plan year ends or by the extended due date, if filing under an

authorized extension of time. Fill in the short plan year beginning and

ending dates in the space provided and check the appropriate box in

Part I, line B, of the Form 5500. For purposes of this return/report,

the short plan year ends on the date of the change in accounting period

or upon the complete distribution of assets of the plan. Also see the

instructions for Final

Return/ Report

to determine if "the final return/report" box in line B should be

checked.

Notes. (1) If the

filing due date falls on a Saturday, Sunday, or Federal holiday, the

return/report may be filed on the next day that is not a Saturday,

Sunday, or Federal holiday. (2)

If the 2016 Form 5500 is not available before the plan or DFE filing is

due, use the 2015 Form 5500 and enter the 2016 fiscal year beginning

and ending dates on the line provided at the top of the form.

Using Form

5558 top

A plan or GIA may obtain a one-time extension of time to

file a Form 5500 annual return/report (up to 2 1/2 months) by filing

IRS Form 5558, Application for Extension of Time To File Certain

Employee Plan Returns, on or before the normal due date (not including

any extensions) of the return/report. You MUST file Form 5558

with the IRS. Approved copies of the Form 5558 will not be

returned to the filer. A copy of the completed extension request must,

however, be retained with the filer's records.

File Form 5558 with the Department of the Treasury, Internal

Revenue Service Center, Ogden, UT 84201-0045.

Using

Extension of Time To File Federal Income Tax Return top

An automatic extension of time to file the Form 5500 annual

return/report until the due date of the federal income tax return of

the employer will be granted if all of the following conditions are

met: (1) the plan year and the employer's tax year

are the same; (2) the employer has been granted an

extension of time to file its federal income tax return to a date later

than the normal due date for filing the Form 5500; and (3)

a copy of the application for extension of time to file the federal

income tax return is maintained with the filer's records. An extension

granted by using this automatic extension procedure CANNOT be extended

further by filing a Form 5558, nor can it be extended beyond a total of

9½ months beyond the close of the plan year.

Note. An extension of time to file the

Form 5500 does not operate as an extension of time to file a Form 5500

filed for a DFE (other than a GIA), to file PBGC premiums or annual

financial and actuarial reports (if required by section 4010 of ERISA)

or to file the Form 8955-SSA (Annual Registration Statement Identifying

Separated Participants with Deferred Vested Benefits) (required to be

filed with the IRS under Code section 6057(a)).

Other

Extensions of Time top

The IRS, DOL, and PBGC may announce special extensions of

time under certain circumstances, such as extensions for

Presidentially-declared disasters or for service in, or in support of,

the Armed Forces of the United States in a combat zone. See www.irs.gov, www.efast.dol.gov,

and www.pbgc.gov/practitioners

for announcements regarding such special extensions. If you are relying

on one of these announced special extensions, check the appropriate box

on Form 5500, Part I, line D, and enter a description of the announced

authority for the extension.

Delinquent

Filer Voluntary Compliance (DFVC) Program top

The DFVC Program facilitates voluntary compliance by plan

administrators who are delinquent in filing annual reports under Title

I of ERISA by permitting administrators to pay reduced civil penalties

for voluntarily complying with their DOL annual reporting obligations.

If the Form 5500 is being filed under the DFVC Program, check the

appropriate box in Form 5500, Part I, line D, to indicate that the Form

5500 is being filed under the DFVC Program. See www.efast.dol.gov

for additional information.

Plan administrators are reminded that they can use the online

calculator available at www.dol.gov/ebsa/calculator/dfvcpmain.html

to compute the penalties due under the program. Payments under the DFVC

Program also may be submitted electronically. For information on how to

pay DFVC Program payments online, go to www.dol.gov/ebsa.

Caution! Filers who wish

to participate

in the DFVC Program for plan years prior to 2012 must use the 2015

version of Form 5500 or, if applicable, Form 5500-SF. Use the Form 5500

Version Selection Tool available at www.efast.dol.gov for further

information.

Under the computerized ERISA Filing Acceptance System

(EFAST2), you must file your 2015 Form 5500 annual return/report

electronically. You may file online using EFAST2's web-based filing

system or you may file through an EFAST2-approved vendor. Detailed

information on electronic filing is available at www.efast.dol.gov.

For telephone assistance, call the EFAST2 Help Line at 1-866-GO-EFAST

(1-866-463-3278). The EFAST2 Help Line is available Monday through

Friday from 8:00 am to 8:00 pm, Eastern Time.

Caution! Annual returns/reports

filed under Title I of ERISA must be made available by plan

administrators to plan participants and beneficiaries and by the DOL to

the public pursuant to ERISA sections 104 and 106. Even though the Form

5500 must be filed electronically, the administrator must keep a copy

of the Form 5500, including schedules and attachments, with all

required signatures on file as part of the plan's records and must make

a paper copy available upon request to participants, beneficiaries, and

the DOL as required by section 104 of ERISA and 29 CFR 2520.103-1.

Filers may use electronic media for record maintenance and retention,

so long as they meet the applicable requirements.

Generally, questions on the Form 5500 relate to the plan year

entered at the top of the first page of the form. Therefore, answer all

questions on the 2015 Form 5500 with respect to the 2015 plan year

unless otherwise explicitly stated in the instructions or on the form

itself.

Your entries must be in the proper format in order for the

EFAST2 system to process your filing. For example, if a question

requires you to enter a dollar amount, you cannot enter a word. Your

software will not let you submit your return/ report unless all entries

are in the proper format. To reduce the possibility of correspondence

and penalties:

- Complete all lines on the Form 5500 unless otherwise

specified. Also complete and electronically attach, as required,

applicable schedules and attachments.

- Do not enter "N/A" or "Not Applicable" on the Form 5500

unless specifically permitted. "Yes" or "No" questions on the forms and

schedules cannot be left blank, unless specifically permitted. Answer

either "Yes" or "No," but not both.

All schedules and attachments to the Form 5500 must be

properly identified, and must include the name of the plan or DFE, EIN,

and plan number (PN) as found on the Form 5500, lines, 1a, 2b, and 1b,

respectively. At the top of each attachment, indicate the schedule and

line, if any (e.g., Schedule H, line 4i) to which

the attachment relates.

Check your return/report for errors before signing or

submitting it to EFAST2. Your filing software or, if you are using it,

the EFAST2 web-based filing system will allow you to check your

return/report for errors. If, after reasonable attempts to correct your

filing to eliminate any identified problem or problems, you are unable

to address them, or you believe that you are receiving the message in

error, call the EFAST2 Help Line at 1-866-GO-EFAST (1-866-463-3278) or

contact the service provider you used to help prepare and file your

annual return/report.

Once you complete the return/report and finish the electronic

signature process, you can electronically submit it to EFAST2. When you

electronically submit your return/report, EFAST2 is designed to

immediately notify you if your submission was received and whether the

return/report is ready to be processed by EFAST2. If EFAST2 does not

notify you that your submission was successfully received and is ready

to be processed, you will need to take steps to correct the problem or

you may be deemed a non-filer subject to penalties from DOL, IRS,

and/or PBGC.

Once EFAST2 receives your return/report, the EFAST2 system

should be able to provide a filing status within 20 minutes. The person

submitting the filing should check back into the EFAST2 system to

determine the filing status of your return/report. The filing status

message will include a list of any filing errors or warnings that

EFAST2 may have identified in your filing. If EFAST2 did not identify

any filing errors or warnings, EFAST2 will show the filing status of

your return/ report as "Filing_Received." Persons other than the

submitter can check whether the filing was received by the system by

calling the EFAST2 Help Line at 1-866-GO-EFAST (1-866-463-3278) and

using the automated telephone system.

To reduce the possibility of correspondence and penalties

from the DOL, IRS, and/or PBGC, you should do the following: (1) Before

submitting your return/report to EFAST2, check it for errors, and (2)

after you have submitted it to EFAST2, verify that you have received a

filing status of "Filing_Received" and attempt to correct and resolve

any errors or warnings listed in the status report.

Note. Even after being received by the

EFAST2 system, your return/report filing may be subject to further

detailed review by DOL, IRS, and/or PBGC, and your filing may be deemed

deficient based upon this further review. See Penalties.

Caution! Do not enter social

security numbers in response to questions asking for an employer

identification number (EIN). Because of privacy concerns, the inclusion

of a social security number or any portion thereof on the Form 5500 or

on a schedule or

attachment that is open to public inspection may result in the

rejection of the filing. If you discover a filing disclosed on the

EFAST2 website that contains a social security number, immediately call

the EFAST2 Help Line at 1-866-GO-EFAST (1-866-463-3278).

Employers without an EIN must apply for one as soon as

possible. The EBSA does not issue EINs. To apply for an EIN from the

IRS:

- Mail or fax Form SS-4, Application for Employer

Identification Number, obtained by calling 1-800-TAX-FORM

(1-800-829-3676) or at the IRS website at www.irs.gov.

- Call 1-800-829-4933 to receive your EIN by telephone.

- Select the Online EIN Application link at www.irs.gov.

The EIN is issued immediately once the application information is

validated. (The online application process is not yet available for

corporations with addresses in foreign countries).

Do not attach a copy of the annual registration

statement (IRS Form 8955-SSA) identifying separated

participants with deferred vested

benefits, or a previous years' Schedule SSA (Form 5500) to your 2015

Form 5500 annual return/report. The annual registration statement must

be filed directly with the IRS and cannot be attached to a Form 5500

submission with EFAST2.

File an amended return/report to correct errors and/or

omissions in a previously filed annual return/report for the 2015 plan

year. The amended Form 5500 and any amended schedules and/or

attachments must conform to the requirements in these instructions. See

the DOL website at www.efast.dol.gov

for information on filing amended returns/ reports for prior years.

TIP. Check the line B box for

"an amended return/report" if you filed a previous 2015 annual

return/report that was given a "Filing_Received," "Filing_Error," or

"Filing_Stopped" status by EFAST2. Do not check the line B box for "an

amended return/report" if your previous submission attempts were not

successfully received by EFAST2 because of problems with the

transmission of your return/report. For more information, go to the

EFAST2 website at www.efast.dol.gov

or call the EFAST2 Help Line at 1-866-GO-EFAST (1-866-463-3278).

If

all assets under the plan (including insurance/annuity

contracts) have been distributed to the participants and beneficiaries

or legally transferred to the control of another plan, and when all

liabilities for which benefits may be paid under a welfare benefit plan

have been satisfied, check the final return/report box in Part I, line

B at the top of the Form 5500. Do not mark the final return/report box

if you are reporting participants and/or assets at the end of the plan

year. If a trustee is appointed for a

terminated defined benefit plan pursuant to ERISA section 4042, the

last plan year for which a return/report must be filed is the year in

which the trustee is appointed. If you are in this situation you may

contact PBGCTrustedPlan@dol.gov for

further information.

Examples:

Mergers/Consolidations

A final return/report should be filed for the plan year (12 months or

less) that ends when all plan assets were legally transferred to the

control of another plan.

Pension and Welfare Plans That Terminated Without

Distributing All Assets

If the plan was terminated, but all plan assets were not distributed, a

return/report must be filed for each year the plan has assets. The

return/report must be filed by the plan administrator, if designated,

or by the person or persons who actually control the plan's

assets/property.

Welfare Plans Still Liable To Pay Benefits

A welfare plan cannot file a final return/report if the plan is still

liable to pay benefits for claims that were incurred prior to the

termination date, but not yet paid. See 29 CFR 2520.104b-2(g)(2)(ii).

For purposes of Title I of ERISA, the plan administrator is

required to file the Form 5500. If the plan administrator does not sign

a filing, the filing status will indicate that there is an error with

your filing, and your filing will be subject to further review,

correspondence, rejection, and civil penalties.

The plan administrator must electronically sign the Form

5500 or Form 5500-SF submitted to EFAST2.

Caution! After submitting your

filing, you must check the Filing Status. If the filing status is

"Processing Stopped" or "Unprocessable", it is possible your submission

was not sent with

a valid electronic signature as required, and depending on the error,

may be considered not to have been filed. By looking closer at the

Filing

Status, you can see specific error messages applicable to the

transmitted filing and determine whether it was sent with a valid

electronic signature and what other errors may need to be corrected.

Note. If the plan administrator is an

entity, the electronic signature must be in the name of a person

authorized to sign on behalf of the plan administrator.

Authorized Service Provider Signatures.

If the plan administrator elects to have a service provider who manages

the filing process for the plan get EFAST2 signing credentials and

submit the electronic Form 5500 for the plan: 1) the service provider

must receive specific written authorization from the plan administrator

to submit the plan's electronic filing; 2) the plan administrator must

manually sign a paper copy of the electronically completed Form 5500,

and the service provider must include a PDF copy of the first two pages

of the manually signed Form 5500 as an attachment to the electronic

Form 5500 submitted to EFAST2; 3) the service provider must communicate

to the plan administrator any inquiries received from EFAST2, DOL, IRS

or PBGC regarding the filing; 4) the service provider must communicate

to the plan administrator that, by electing to use this option, the

image of the plan administrator's manual signature will be included

with the rest of the return/report posted by the Labor Department on

the Internet for public disclosure; and 5) the plan administrator must

keep the manually signed copy of the Form 5500, with all required

schedules and attachments, as part of the plan's records. For more

information on the electronic signature option, see the EFAST2

All-Electronic Filing System FAQs at www.dol.gov/ebsa/faqs/faq-EFAST2.html.

Caution! Service providers should

consider implications of IRS tax return preparer rules.

Note. The Code permits either the plan

sponsor/employer or the administrator to sign the filing. However, any

Form 5500 that is not electronically signed by the plan administrator

will be subject to rejection and civil penalties under Title I of ERISA.

For DFE filings, a person authorized to sign on behalf of the

DFE must sign for the DFE.

The Form 5500 annual return/report must be filed

electronically and signed. To obtain an electronic signature, go to www.efast.dol.gov

and register in EFAST2 as a signer. You will be provided with a UserID

and PIN. Both the UserID and PIN are needed to sign the Form 5500. The

plan administrator must keep a copy of the Form 5500, including

schedules and attachments with all required signatures on file as part

of the plan's records. See 29 CFR 2520.103-1.

Electronic signatures on annual returns/reports filed under

EFAST2 are governed by the applicable statutory and regulatory

requirements.

For

the 2015 plan year, the IRS has decided not to require plan sponsors to

enter the “Preparer’s name (including firm’s name, if applicable),

address, and telephone number” at the bottom of the first page of Form

5500. Plan sponsors should skip these questions when completing the

form.

ftw Note. The Preparer's

Information is made

available to the public on the EFAST website.

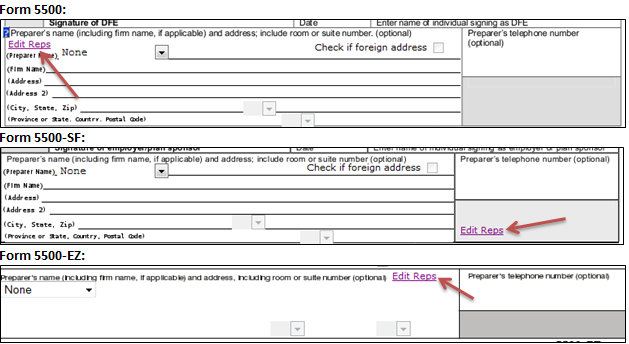

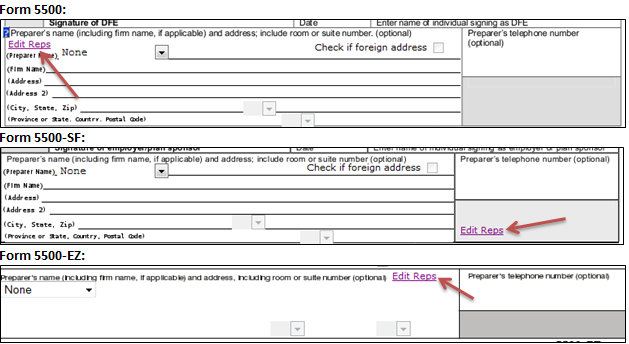

ftw Note. Starting with the 2012 Forms, an

option was added to enter the preparer's information. The ftwilliam.com

software now allows you to set up a default preparer(s) so that you do

not have to continually type in the data manually for each form. Once

in the draft Form 5500/SF/EZ, click on 'Edit Reps' (see image below).

Next, click on "Add Rep" where you will enter the Rep's First and Last

Name. Then, select the new rep from the list and click on "Select Rep".

Any Rep created will be visible in the Preparer's drop-down list on the

Form 5500/SF/EZ. You may also type in the Preparer information manually

if you do not wish to set up defaults.

Generally, only defined benefit pension plans need to get

approval for a change in the plan year. See Code section

412(d)(1).

However, under Rev. Proc. 87-27, 1987-1 C.B. 769, these pension plans

may be eligible for automatic approval of a change in plan year.

If a change in plan year for a pension or welfare benefit

plan creates a short plan year, file the form and applicable schedules

by the last day of the 7th calendar month after

the short plan year ends or by the extended due date, if filing under

an authorized extension of time. Fill in the short plan year beginning

and ending dates in the space provided in Part I and check the

appropriate box in Part I, line B of the Form 5500. For purposes of

this return/report, the short plan year ends on the date of the change

in accounting period or upon the complete distribution of assets of the

plan. Also, see the instructions for the Final

Return/Report to determine if "final return/report" in line B

should be checked.

Plan administrators and plan sponsors must provide complete

and accurate information and must otherwise comply fully with the

filing requirements. ERISA and the Code provide for the DOL and the

IRS, respectively, to assess or impose penalties for not giving

complete and accurate information and for not filing complete and

accurate statements and returns/reports. Certain penalties are

administrative (i.e., they may be imposed or

assessed by one of the governmental agencies delegated to administer

the collection of the annual return/report data). Others require a

legal conviction.

Administrative

Penalties

Listed below are various penalties under ERISA and the Code that may be

assessed or imposed for not meeting the annual return/report filing

requirements. Generally, whether the penalty is under ERISA or the

Code, or both, depends upon the agency for which the information is

required to be filed. One or more of the following administrative

penalties may be assessed or imposed in the event of incomplete filings

or filings received after the due date unless it is determined that

your failure to file properly is for reasonable cause:

- A penalty of up to $1,100 a day (or higher amount if

adjusted pursuant to the Federal Civil Penalties Inflation Adjustment

Act of 1990, as amended) for each day a plan administrator fails or

refuses to file a complete and accurate report. See ERISA section

502(c)(2) and 29

CFR 2560.502c-2.

- A penalty of $25 a day (up to $15,000) for not filing

returns for certain plans of deferred compensation, trusts and

annuities, and bond purchase plans by the due date(s). See Code section

6652(e).

- A penalty of $1,000 for each failure to file an actuarial

statement

(Schedule

MB (Form 5500) or Schedule SB (Form

5500)) required by the applicable instructions. See Code section 6692.

Other

Penalties

- Any individual who willfully violates any provision of

Part 1 of Title I of ERISA shall on conviction be fined not more than

$100,000 or imprisoned not more than 10 years, or both. See ERISA

section 501.

- A penalty up to $10,000, five (5) years imprisonment, or

both, may be imposed for making any false statement or representation

of fact, knowing it to be false, or for knowingly concealing or not

disclosing any fact required by ERISA. See section 1027, Title 18, U.S.

Code, as amended by section 111 of ERISA.

The Form

5500 reporting requirements

vary depending on

whether the Form 5500 is being filed for a "large plan," a "small

plan," and/or a DFE, and on the particular type of plan or DFE involved

(e.g., welfare plan, pension plan, common/collective

trust (CCT), pooled separate account (PSA), master trust investment

account (MTIA), 103-12 IE, or group insurance arrangement (GIA)).

The instructions below provide detailed information about

each of the Form 5500 schedules and which plans and DFEs are required

to file them.

The schedules are grouped in the instructions by type: (1)

Pension Benefit Schedules and (2) General

Schedules. Each schedule is listed separately with a description of the

subject matter covered by the schedule and the plans and DFEs that are

required to file the schedule.

Filing requirements also are listed by type of filer: (1)

Pension Benefit Plan Filing Requirements; (2)

Welfare Benefit Plan Filing Requirements; and (3)

DFE Filing Requirements. For each filer type there is a separate list

of the schedules that must be filed with the Form 5500 (including where

applicable, separate lists for large plan filers, small plan filers,

and different types of DFEs).

The filing requirements also are summarized in a Quick

Reference Chart of Form 5500, Schedules, and Attachments.

Generally, a return/report filed for a pension benefit plan

or welfare benefit plan that covered fewer than 100 participants as of

the beginning of the plan year should be completed following the

requirements below for a "small plan," and a return/report filed for a

plan that covered 100 or more participants as of the beginning of the

plan year should be completed following the requirements below for a

"large plan."

Use the number of participants required to be entered in line

5 of the Form 5500 to determine whether a plan is a "small plan" or

"large plan."

Exceptions:

(1) 80-120 Participant Rule: If the number of

participants reported on line 5 is between 80 and 120,

and a Form 5500 annual return/report was filed for the prior plan year,

you may elect to complete the return/report in the same category

("large plan" or "small plan") as was filed for the prior

return/report. Thus, if a Form 5500-SF or a Form 5500 annual

return/report was filed for

the 2014 plan year as a small plan, including the Schedule I if

applicable, and the number entered on line 5 of the 2015 Form 5500 is

120 or less, you may elect to complete the 2015 Form 5500 and schedules

in accordance with the instructions for a small plan, including for

eligible filers, filing the Form 5500-SF instead of the Form 5500.

(2) Short Plan

Year Rule: If

the plan had

a short plan year of seven (7) months or less for either the prior plan

year or the plan year being reported on the 2015 Form 5500, an election

can be made to defer filing the accountant's report in accordance with

29 CFR 2520.104-50. If such an election was made for the prior plan

year, the 2015 Form 5500 must be completed following the requirements

for a large plan, including the attachment of the Schedule H and the

accountant's reports, regardless of the number of participants entered

in Part II, line 5.

Schedule R (Retirement Plan Information)

- is required for a pension benefit plan that is a defined benefit plan

or is otherwise subject to Code section 412 or ERISA section 302.

Schedule R may also be required for certain other pension benefit plans

unless otherwise specified under Limited

Pension Plan Reporting. For

additional information, see the Schedule R

instructions.

Schedule MB (Multiemployer Defined

Benefit Plan and Certain Money Purchase Plan Actuarial Information)

- is required for most multiemployer defined benefit plans and for

defined contribution pension plans that currently amortize a waiver of

the minimum funding requirements specified in the instructions for the

Schedule MB. For additional information, see the instructions for the Schedule

MB and the Schedule

R.

Schedule SB (Single-Employer Defined

Benefit Plan Actuarial Information) - is required

for most single-employer defined benefit plans, including

multiple-employer defined benefit pension plans. For additional

information, see the instructions for the Schedule SB.

Schedule H (Financial Information)

- is required for pension benefit plans and welfare benefit plans

filing as "large plans" and for all DFE filings. Employee benefit

plans, 103-12 IEs, and GIAs filing the Schedule H are generally

required to engage an independent qualified public accountant (IQPA)

and attach a report of the IQPA pursuant to ERISA section 103(a)(3)(A).

These plans and DFEs are also generally required to attach to the Form

5500 a "Schedule of Assets (Held At End of Year),"

and, if applicable, a "Schedule of Assets (Acquired and

Disposed of Within Year)," a "Schedule of

Reportable Transactions," and a "Schedule of

Delinquent Participant Contributions." For additional

information, see the Schedule

H

instructions.

Exceptions: Insured, unfunded, or

combination unfunded/insured welfare plans, as described in 29 CFR

2520.104-44(b)(1), and certain pension plans and arrangements, as

described in 29 CFR 2520.104-44(b)(2), and in Limited

Pension Plan

Reporting, are exempt from completing the Schedule H.

Schedule I (Financial Information - Small

Plan) - is required for all pension benefit plans

and welfare benefit plans filing the Form 5500 annual return/report,

rather than the Form 5500-SF, as "small plans," except for certain

pension benefit plans and arrangements described in 29 CFR

2520.104-44(b)(2) and Limited

Pension Plan Reporting. For additional

information, see the Schedule

I

instructions.

Note: A welfare plan that would have been

eligible for the filing exemption under 29 CFR 2520.104-20, but for the

fact that it is required to file a Form M-1, is exempt from completing

a Schedule I if it meets the requirements of 29 CFR 2520.104-44(b)(1).

Schedule A (Insurance Information)

- is required if any benefits under an employee benefit plan are

provided by an insurance company, insurance service or other similar

organization (such as Blue Cross, Blue Shield, or a health maintenance

organization). This includes investment contracts with insurance

companies, such as guaranteed investment contracts and pooled separate

accounts. For additional information, see the Schedule A

instructions.

Note. Do not file Schedule A for

Administrative Services Only (ASO) contracts. Do not file Schedule A if

a Schedule A is filed for the contract as part of the Form 5500 filed

directly by a master trust investment account (MTIA) or 103-12 IE.

Schedule C (Service Provider Information)

- is required for a large plan, MTIA, 103-12 IE, or GIA if (1)

any service provider who rendered services to the plan or DFE during

the plan or DFE year received $5,000 or more in compensation, directly

or indirectly from the plan or DFE, or (2) an

accountant and/or enrolled actuary has been terminated. For additional

information, see the Schedule

C

instructions.

Schedule D (DFE/Participating Plan

Information) - Part I is required for a plan or DFE

that invested or participated in any MTIAs, 103-12 IEs, CCTs, and/or

PSAs. Part II is required when the Form 5500 is filed for a DFE. For

additional information, see the Schedule D

instructions.

Schedule G (Financial Transaction

Schedules) - is required for a large plan, MTIA,

103-12 IE, or GIA when Schedule H (Financial Information) lines 4b, 4c,

and/or 4d are checked "Yes." Part I of the Schedule G reports loans or

fixed income obligations in default or classified as uncollectible.

Part II of the Schedule G reports leases in default or classified as

uncollectible. Part III of the Schedule G reports nonexempt

transactions. For additional information, see the Schedule G

instructions.

Caution! An unfunded, fully

insured, or combination unfunded/ insured welfare plan with 100 or more

participants exempt under 29 CFR 2520.104-44 from completing Schedule H

must still complete Schedule G, Part III, to report nonexempt

transactions.

Pension benefit plan filers must complete the Form 5500

annual return/report, including the signature block and, unless

otherwise specified, attach the following schedules and information:

Small Pension

Plan

The following schedules (including any additional information required

by the instructions to the schedules) must be attached to a Form 5500

filed for a small pension plan that is neither exempt from filing nor

is filing the Form 5500-SF:

- Schedule A (as many as needed), to report insurance,

annuity, and investment contracts held by the plan.

- Schedule D, Part I, to list any CCTs, PSAs, MTIAs, and

103-12 IEs in which the plan participated at any time during the plan

year.

- Schedule I, to report small plan financial information,

unless exempt.

- Schedule MB or SB, to report actuarial information, if

applicable.

- Schedule R, to report retirement plan information, if

applicable.

Caution! If Schedule I, line

4k, is checked "No," you must attach the report of the independent

qualified public accountant (IQPA) or a statement that the plan is

eligible and elects to defer attaching the IQPA's opinion pursuant to

29 CFR 2520.104-50 in connection with a short plan year of seven months

or less.

Large Pension

Plan

The following schedules (including any additional information required

by the instructions to the schedules) must be attached to a Form 5500

filed for a large pension plan:

- Schedule A (as many as needed), to report insurance,

annuity, and investment contracts held by the plan.

- Schedule C, if applicable, to report information on

service providers and, if applicable, any terminated accountants or

enrolled actuaries.

- Schedule D, Part I, to list any CCTs, PSAs, MTIAs, and

103-12 IEs in which the plan invested at any time during the plan year.

- Schedule G, to report loans or fixed income obligations

in default or determined to be uncollectible as of the end of the plan

year, leases in default or classified as uncollectible, and nonexempt

transactions, i.e., file Schedule G if Schedule H

(Form 5500) lines 4b, 4c, and/or 4d are checked "Yes."

- Schedule H, to report large plan financial information,

unless exempt.

- Schedule MB or SB, to report actuarial information, if

applicable.

- Schedule R, to report retirement plan information, if

applicable.

Eligible

Combined Plans

Section 903 of (PPA) established rules for a new type of pension plan,

an "eligible combined plan," effective for plan years beginning after

December 31, 2009. See Code section 414(x) and ERISA section 210(e). An

eligible combined plan consists of a defined benefit plan and a defined

contribution plan that includes a qualified cash or deferred

arrangement under Code section 401(k), with the assets of the two plans

held in a single trust, but clearly identified and allocated between

the plans. The eligible combined plan design is available only to

employers that employed an average of at least two, but not more than

500 employees, on business days during the calendar year preceding

the plan year as of which the eligible combined plan is established and

that employs at least two employees on the first day of the plan year

that the plan is established.

Because an eligible combined plan includes both a defined benefit plan

and a defined contribution plan, the Form 5500 filed for the plan must

include all the information, schedules, and attachments that would be

required for either a defined benefit plan (such as a Schedule SB) or a

defined contribution plan.

Limited

Pension Plan Reporting

The pension benefit plans or arrangements described below are eligible

for limited annual reporting:

- IRA Plans: A pension plan using

individual retirement accounts or annuities (as described in Code

section 408) as the sole funding vehicle for providing pension benefits

need complete only Form 5500, Part I and Part II, lines 1 through 4,

and 8 (enter pension feature code 2N).

- Fully Insured Pension Plan: A pension

benefit plan providing benefits exclusively through an insurance

contract or contracts that are fully guaranteed and that meet all of

the conditions of 29 CFR 2520.104-44(b)(2) during the entire plan year

must complete all the requirements listed under this Pension

Benefit Plan Filing Requirements section, except that such a

plan is exempt from attaching Schedule H, Schedule I, and an

independent qualified public accountant's opinion, and from the

requirement to engage an IQPA.

A pension benefit plan that has insurance contracts of the

type described in 29 CFR 2520.104-44 as well as other assets must

complete all requirements for a pension benefit plan, except that the

value of the plan's allocated contracts (see below) should not be

reported in Part I of Schedule H or I. All other assets should be

reported on Schedule H or Schedule I, and any other required schedules.

If Schedule H is filed, attach an accountant's report in accordance

with the Schedule H instructions.

Note. For purposes of the annual

return/report and the alternative method of compliance set forth in 29

CFR 2520.104-44, a contract is considered to be "allocated" only if the

insurance company or organization that issued the contract

unconditionally guarantees, upon receipt of the required premium or

consideration, to provide a retirement benefit of a specified amount.

This amount must be provided to each participant without adjustment for

fluctuations in the market value of the underlying assets of the

company or organization, and each participant must have a legal right

to such benefits, which is legally enforceable directly against the

insurance company or organization. For example, deposit administration,

immediate participation guarantee, and guaranteed investment contracts

are NOT allocated contracts for Form 5500 annual return/report purposes.

Welfare benefit plan filers must complete the Form 5500

annual return/report, including the signature block and, unless

otherwise specified, attach the following schedules and information:

Small Welfare

Plan

The following schedules (including any additional information required

by the instructions to the schedules) must be attached to a Form 5500

filed for a small welfare plan that is neither exempt from filing nor

filing the Form 5500-SF:

- Schedule A (as many as needed), to report insurance

contracts held by the plan.

- Schedule D, Part I, to list any CCTs, PSAs, MTIAs, and

103-12 IEs in which the plan participated at any time during the plan

year.

- Schedule I, to report small plan financial information.

TIP. A welfare plan that

covered fewer than 100 participants as of the beginning of the plan

year and is required to file a Form M-1, Report for Multiple Employer

Welfare Arrangements (MEWAs) and Certain Entities Claiming Exception

(ECEs), is exempt from attaching Schedule I if the plan meets the

requirements of 29 CFR 2520.104-44. However, Schedule G, Part III, must

be attached to the Form 5500 to report any nonexempt transactions.

Large Welfare

Plan

The following schedules (including any additional information required

by the instructions to the schedules) must be attached to a Form 5500

filed for a large welfare plan:

- Schedule A (as many as needed), to report insurance and

investment contracts held by the plan.

- Schedule C, if applicable, to report information on

service providers and any terminated accountants or actuaries.

- Schedule D, Part I, to list any CCTs, PSAs, MTIAs, and

103-12 IEs in which the plan invested at any time during the plan year.

- Schedule G, to report loans or fixed income obligations

in default or determined to be uncollectible as of the end of the plan

year, leases in default or classified as uncollectible, and nonexempt

transactions, i.e., file Schedule G if Schedule H

(Form 5500) lines 4b, 4c, and/or 4d are checked "Yes" or if a large

welfare plan that is not required to file a Schedule H has nonexempt

transactions.

- Schedule H, to report financial information, unless

exempt.

TIP. Attach the report of

the independent qualified public accountant (IQPA) identified on

Schedule H, line 3c, unless line 3d(2) is checked.

Caution! Neither

Schedule H nor an

IQPA's opinion should be attached to a Form 5500 filed for an unfunded,

fully insured or combination unfunded/insured welfare plan that covered

100 or more participants as of the beginning of the plan year that

meets the requirements of 29 CFR 2520.104-44. However, Schedule G, Part

III, must be attached to the Form 5500 to report any nonexempt

transactions. A welfare benefit plan that uses a "voluntary employees'

beneficiary association" (VEBA) under Code section 501(c)(9) is

generally not exempt from the requirement of engaging an IQPA.

Some plans participate in certain trusts, accounts, and

other investment arrangements that file the Form 5500 annual

return/report as a DFE. A Form 5500 must be filed for a master trust

investment account (MTIA). A Form 5500 is not required but may be filed

for a common/collective trust (CCT), pooled separate account (PSA),

103-12 investment entity (103-12 IE), or group insurance arrangement

(GIA). However, plans that participate in CCTs, PSAs, 103-12 IEs, or

GIAs that file as DFEs generally are eligible for certain annual

reporting relief. For reporting purposes, a CCT, PSA, 103-12 IE, or GIA

is considered a DFE only when a Form 5500 and all required schedules

and attachments are filed for it in accordance with the following

instructions.

Only one Form 5500 should be filed for each DFE for all plans

participating in the DFE; however, the Form 5500 filed for the DFE,

including all required schedules and attachments, must report

information for the DFE year (not to exceed 12 months in length) that

ends with or within the participating plan's year.

Any Form 5500 filed for a DFE is an integral part of the

annual report of each participating plan, and the plan administrator

may be subject to penalties for failing to file a complete annual

report unless both the DFE Form 5500 and the plan's Form 5500 are

properly filed. The information required for a Form 5500 filed for a

DFE varies according to the type of DFE. The following paragraphs

provide specific guidance for the reporting requirements for each type

of DFE.

Master

Trust Investment Account (MTIA) top

The administrator filing a Form 5500 for an employee benefit plan is

required to file or have a designee file a Form 5500 for each MTIA in

which the plan participated at any time during the plan year. For

reporting purposes, a "master trust" is a trust for which a regulated

financial institution (as defined below) serves as trustee or custodian

(regardless of whether such institution exercises discretionary

authority or control with respect to the management of assets held in

the trust), and in which assets of more than one plan sponsored by a

single employer or by a group of employers under common control are

held.

"Common control" is determined on the basis of all relevant

facts and circumstances (whether or not such employers are

incorporated).

A "regulated financial institution" means a bank, trust

company, or similar financial institution that is regulated,

supervised, and subject to periodic examination by a state or federal

agency. A securities brokerage firm is not a "similar financial

institution" as used here. See DOL Advisory Opinion 93-21A (available

at www.dol.gov/ebsa).

The assets of a master trust are considered for reporting

purposes to be held in one or more "investment accounts." A "master

trust investment account" may consist of a pool of assets or a single

asset. Each pool of assets held in a master trust must be treated as a

separate MTIA if each plan that has an interest in the pool has the

same fractional interest in each asset in the pool as its fractional

interest in the pool, and if each such plan may not dispose of its

interest in any asset in the pool without disposing of its interest in

the pool. A master trust may also contain assets that are not held in

such a pool. Each such asset must be treated as a separate MTIA.

Notes. (1) If an MTIA

consists solely of one plan's asset(s) during the reporting period, the

plan may report the asset(s) either as an investment account on an MTIA

Form 5500, or as a plan asset(s) that is not part of the master trust

(and therefore subject to all instructions concerning assets not held

in a master trust) on the plan's Form 5500. (2)

If a master trust holds assets attributable to participant or

beneficiary directed transactions under an individual account plan and

the assets are interests in registered investment companies, interests

in contracts issued by an insurance company licensed to do business in

any state, interests in common/collective trusts maintained by a bank,

trust company or similar institution, or the assets have a current

value that is readily determinable on an established market, those

assets may be treated as a single MTIA.

The Form 5500 submitted for the MTIA must comply with the

Form 5500 instructions for a Large

Pension Plan, unless otherwise specified in the forms and

instructions. The MTIA must file:

- Form 5500, except lines C, D, 1c, 2d, and 5 through 9. Be

certain to enter "M" in Part I, line A, as the DFE code.

- Schedule A (as many as needed) to report insurance,

annuity and investment contracts held by the MTIA.

- Schedule C, if applicable, to report service provider

information. Part III is not required for an MTIA.

- Schedule D, to list CCTs, PSAs, and 103-12 IEs in which

the MTIA invested at any time during the MTIA year and to list all

plans that participated in the MTIA during its year.

- Schedule G, to report loans or fixed income obligations

in default or determined to be uncollectible as of the end of the MTIA

year, all leases in default or classified as uncollectible, and

nonexempt transactions.

- Schedule H, except lines 1b(1), 1b(2), 1c(8), 1g, 1h, 1i,

2a, 2b(1)(E), 2e, 2f, 2g, 4a, 4e, 4f, 4g, 4h, 4k, 4l, 4m, 4n, and 5, to

report financial information. An independent qualified public

accountant's (IQPA's) opinion is not required for an MTIA.

- Additional information required by the instructions to

the above schedules, including, for example, the schedules of assets

held for investment and the schedule of reportable transactions. For

purposes of the schedule of reportable transactions, the 5% figure

shall be determined by comparing the current value of the transaction

at the transaction date with the current value of the investment

account assets at the beginning of the applicable fiscal year of the

MTIA. All attachments must be properly labeled.

Common/Collective

Trust (CCT) and Pooled Separate Account (PSA) top

A Form 5500 is not required to be filed for a CCT or PSA.

However, the administrator of a large plan or DFE that participates in

a CCT or PSA that files as specified below is entitled to reporting

relief that is not available to plans or DFEs participating in a CCT or

PSA for which a Form 5500 is not filed.

For reporting purposes, "common/collective trust" and "pooled

separate account" are, respectively: (1)

a trust maintained by a bank, trust company, or similar institution or (2)

an account maintained by an insurance carrier, which is regulated,

supervised, and subject to periodic examination by a state or federal

agency in the case of a CCT, or by a state agency in the case of a PSA,

for the collective investment and reinvestment of assets contributed

thereto from employee benefit plans maintained by more than one

employer or controlled group of corporations as that term is used in

Code section 1563. See 29 CFR 2520.103-3, 103-4, 103-5, and 103-9.

Note. For reporting purposes, a separate

account that is not considered to be holding plan assets pursuant to 29

CFR 2510.3-101(h)(1)(iii) does not constitute a pooled separate account.

The Form 5500 submitted for a CCT or PSA must comply with the

Form 5500 instructions for a Large

Pension Plan, unless otherwise specified in the forms and

instructions.

The CCT or PSA must file:

- Form 5500, except lines C, D, 1c, 2d, and 5 through 9.

Enter "C" or "P," as appropriate, in Part I, line A, as the DFE code.

- Schedule D, to list all CCTs, PSAs, MTIAs, and 103-12 IEs

in which the CCT or PSA invested at any time during the CCT or PSA year

and to list in Part II all plans that participated in the CCT or PSA

during its year.

- Schedule H, except lines 1b(1), 1b(2), 1c(8), 1d, 1e, 1g,

1h, 1i, 2a, 2b(1)(E), 2e, 2f, and 2g, to report financial information.

Part IV and an accountant's (IQPA's) opinion are not required for a CCT

or PSA.

Caution! Different requirements apply to the

Schedules D and H attached to the Form 5500 filed by plans and DFEs

participating in CCTs and PSAs, depending upon whether a DFE Form 5500

has been filed for the CCT or PSA. See the instructions for these

schedules.

103-12

Investment Entity (103-12 IE) top

DOL Regulation 2520.103-12 provides an alternative method of

reporting for plans that invest in an entity (other than an MTIA, CCT,

or PSA), whose underlying assets include "plan assets" within the

meaning of 29 CFR 2510.3-101 of two or more plans that are not members

of a "related group" of employee benefit plans. Such an entity for

which a Form 5500 is filed constitutes a "103-12 IE." A Form 5500 is

not required to be filed for such entities; however, filing a Form 5500

as a 103-12 IE provides certain reporting relief, including the

limitation of the examination and report of the independent qualified

public accountant (IQPA) provided by 29 CFR 2520.103-12(d), to

participating plans and DFEs. For this reporting purpose, a "related

group" of employee benefit plans consists of each group of two or more

employee benefit plans (1) each

of which receives 10% or more of its aggregate contributions from the

same employer or from a member of the same controlled group of

corporations (as determined under Code section 1563(a), without regard

to Code section 1563(a)(4) thereof); or (2)

each of which is either maintained by, or maintained pursuant to a

collective-bargaining agreement negotiated by, the same employee

organization or affiliated employee organizations. For purposes of this

paragraph, an "affiliate" of an employee organization means any person

controlling, controlled by, or under common control with such

organization. See 29 CFR 2520.103-12.

The Form 5500 submitted for a 103-12 IE must comply with the

Form 5500 instructions for a Large

Pension Plan, unless otherwise specified in the forms and

instructions. The 103-12 IE must file:

- Form 5500, except lines C, D, 1c, 2d, and 5 through 9.

Enter "E" in part I, line A, as the DFE code.

- Schedule A (as many as needed), to report insurance,

annuity and investment contracts held by the 103-12 IE.

- Schedule C, if applicable, to report service provider

information and any terminated accountants.

- Schedule D, to list all CCTs, PSAs, and 103-12 IEs in

which the 103-12 IE invested at any time during the 103-12 IE's year,

and to list all plans that participated in the 103-12 IE during its

year.

- Schedule G, to report loans or fixed income obligations

in default or determined to be uncollectible as of the end of the

103-12 IE year, leases in default or classified as uncollectible, and

nonexempt transactions.

- Schedule H, except lines 1b(1), 1b(2), 1c(8), 1d, 1e, 1g,

1h, 1i, 2a, 2b(1)(E), 2e, 2f, 2g, 4a, 4e, 4f, 4g, 4h, 4j, 4k, 4l, 4m,

4n, and 5, to report financial information.

- Additional information required by the instructions to

the above schedules, including, for example, the report of the

independent qualified public accountant (IQPA) identified on Schedule

H, line 3c, and the schedule(s) of assets held for investment. All

attachments must be properly labeled.

Group

Insurance Arrangement (GIA) top

Each welfare benefit plan that is part of a group insurance

arrangement is exempt from the requirement to file a Form 5500 if a

consolidated Form 5500 report for all the plans in the arrangement was

filed in accordance with 29 CFR 2520.104-43. For reporting purposes, a

"group insurance arrangement" provides benefits to the employees of two

or more unaffiliated employers (not in connection with a multiemployer

plan or a collectively-bargained multiple-employer plan), fully insures

one or more welfare plans of each participating employer, uses a trust

or other entity as the holder of the insurance contracts, and uses a

trust as the conduit for payment of premiums to the insurance company.

The GIA must file:

- Form 5500, except lines C and 2d. (Enter "G" in Part I,

line A, as the DFE code).

- Schedule A (as many as needed), to report insurance,

annuity and investment contracts held by the GIA.

- Schedule C, if applicable, to report service provider

information and any terminated accountants.

- Schedule D, to list all CCTs, PSAs, and 103-12 IEs in

which the GIA invested at any time during the GIA year, and to list all

plans that participated in the GIA during its year.

- Schedule G, to report loans or fixed income obligations

in default or determined to be uncollectible as of the end of the GIA

year, leases in default or classified as uncollectible, and nonexempt

transactions.

- Schedule H, except lines 4a, 4e, 4f, 4g, 4h, 4k, 4m, 4n,

and 5, to report financial information.

- Additional information required by the instructions to

the above schedules, including, for example, the report of the

independent qualified public accountant (IQPA) identified on Schedule

H, line 3c, the schedules of assets held for investment and the

schedule of reportable transactions. (All attachments must be properly